Table of Contents

Mitigate FEOC risk, secure your tax credits.

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, has reshaped the U.S. solar industry. With strict new Foreign Entity of Concern (FEOC) restrictions, updated construction rules, and fast-approaching deadlines, developers and investors must act now to safeguard incentives.

At ESAS, we provide the expertise, compliance guidance, and trusted supply chain solutions you need to secure tax credits before they expire.

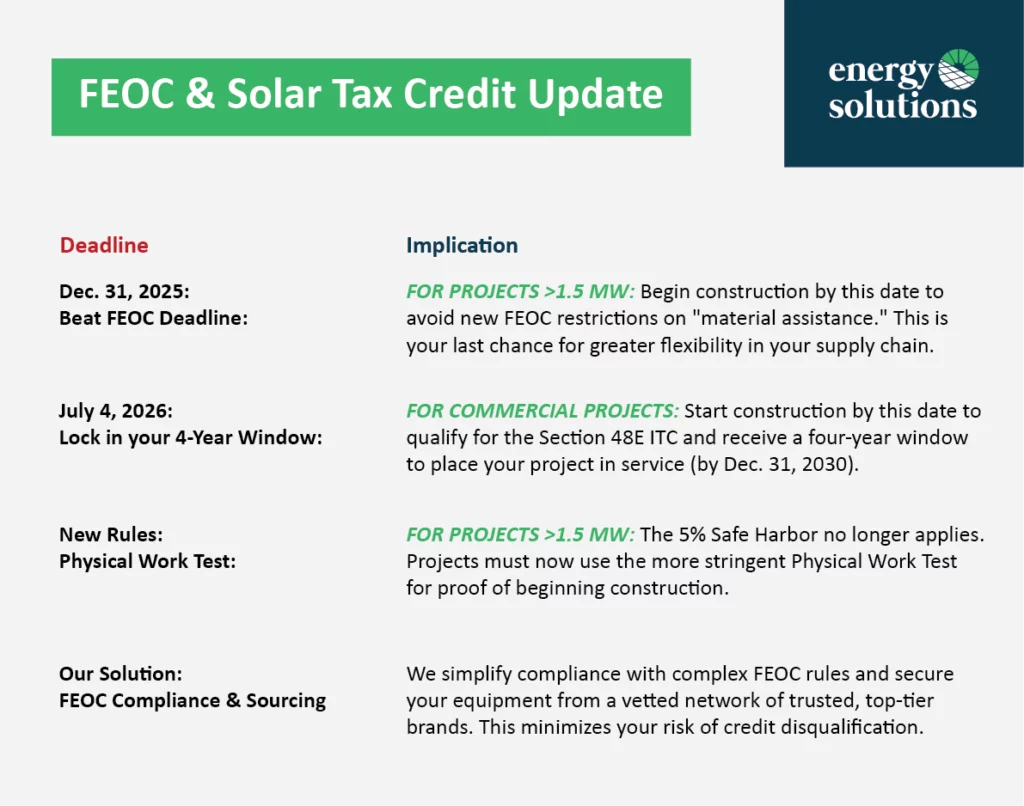

FEOC & Solar Tax Credit Update

Key Deadlines You Cannot Miss

- December 31, 2025 – Beat the FEOC Deadline

For projects greater than 1.5 MW, construction must begin before this date to avoid new FEOC restrictions on “material assistance.” This is the last chance for flexibility in your supply chain. - July 4, 2026 – Lock in Your 4-Year Window

Commercial projects starting construction by this date qualify for the Section 48E Investment Tax Credit (ITC). This secures a four-year window to place your project in service (until December 31, 2030).

New Compliance Rules

- Physical Work Test Now Required:

The 5% Safe Harbor provision is eliminated for projects over 1.5 MW. Developers must now pass the Physical Work Test, which requires proof of on-site or off-site physical work to establish construction start.

Our Solution: FEOC Compliance & Trusted Sourcing

Navigating FEOC restrictions and securing eligible tax credits is complex. At ESAS, we:

- Simplify FEOC compliance for projects of all sizes.

- Source equipment only from a vetted network of top-tier, trusted brands.

- Minimize your risk of credit disqualification and project delays.

- Provide proactive guidance to stay ahead of policy changes.

Why Immediate Action is Critical

The solar market is entering a decisive phase:

- Residential credits are expiring soon.

- Large commercial projects face stricter FEOC rules.

- The 5% Safe Harbor is gone, meaning greater scrutiny of compliance.

Every missed deadline can mean lost incentives, reduced returns, and higher project costs. By partnering with ESAS, you gain the expertise and supply chain security needed to move forward confidently.

Final Word

The OBBBA 2025 changes are a wake-up call for the solar industry. Success now depends on timing, compliance, and trusted sourcing. ESAS is here to help you navigate the complexities, mitigate FEOC risk, and secure the full value of your solar tax credits.

Act today, before the deadlines close your window of opportunity.

Get in touch with our team, schedule a meeting today.