Table of Contents

Let’s be honest. The biggest problem on your desk isn’t the module’s datasheet. It’s the delivery date .

If you’re a C&I solar developer or EPC, you’ve lived this scenario:

You secure the contract, model the returns, and line up procurement. Everything is on track until it isn’t. A two-week inverter ETA becomes four. A racking shipment gets stuck behind port congestion. Suddenly a project expected to energize in Q4 slips into the next year.

These aren’t minor disruptions. These are profit killers. In today’s market, the companies who win aren’t the ones with the cheapest equipment they’re the ones who deliver certainty.

Why Predictability Is Now the Most Valuable Commodity in C&I Solar

The U.S. solar industry continues to grow, and SEIA’s latest reports show that the C&I segment remains one of the most stable sources of nationwide installations[1]. But the same data highlights the underlying fragility that is costing EPCs time, margin, and reputation.

1. Delays Quietly Destroy Project Profitability

Supply chain and interconnection delays remain two of the leading causes of commercial project overruns according to Wood Mackenzie[2].

Every delay compounds:

- Higher labor costs

- Extended staging and storage

- Missed PPA milestones

- Lost client confidence

Many projects with strong financial models lose margins not because of hardware costs, but because a single missing component halted installation.

2. The Supply Chain Is Still Volatile, Just in New Ways

Module pricing stabilized in 2024–2025, but new pressure points emerged:

- Transformers and BOS gear experiencing rising lead times (DOE SETO)[3]

- Localized freight bottlenecks across U.S. ports (SEIA Market Insight)[1]

- Domestic content demand pushing certain components into scarcity

Depending on Just-in-Time procurement today is a strategic risk.

3. A Missed Delivery Damages Trust

Commercial clients care about one metric: When will the system produce energy?

If delays push ROI milestones or shift commissioning dates, your reputation, not your supplier’s takes the hit.

Your real competitive advantage isn’t just selling solar.

It’s delivering predictability.

Why the Next Leaders in C&I Solar Will Be the Ones Who Master Logistics

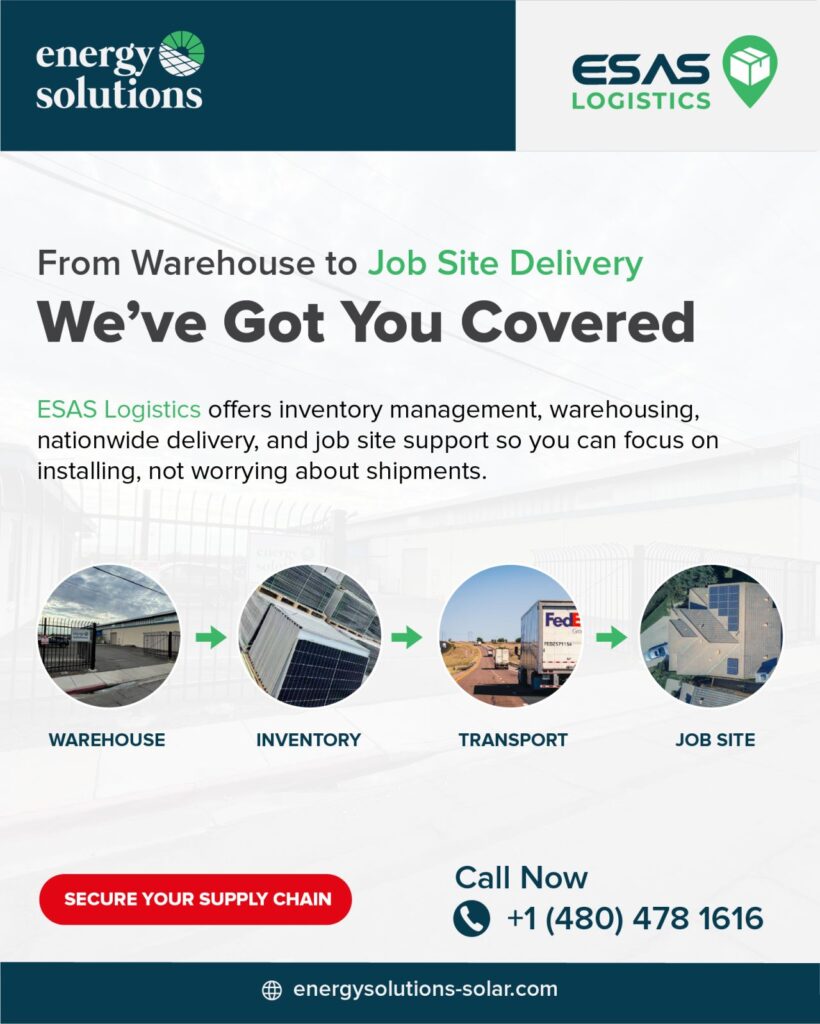

This shift is why ESAS developed a logistics-first services model. Not to move boxes, but to remove the uncertainty that slows developers down.

Here’s where we see developers gaining the strongest advantage.

How ESAS Helps Developers Take Control of Their Project Outcomes

1. A Distributed Network of 6 Strategic Warehouses

Instead of relying on long-haul freight routes or single-coast distribution centers, ESAS positioned inventory across six strategic warehouses nationwide.

That proximity matters.

NREL’s soft-cost benchmarking shows that shortening logistics chains can reduce BOS soft costs by 10-15% on many commercial projects[4].

What this means for your project:

- Shorter delivery windows

- Lower freight cost exposure

- Rapid re-routing when schedules change

- Less vulnerability to weather or port delays

Your project moves because your supply chain is already close.

2. Whole-System Availability to Eliminate Partial-Delivery Delays

A project doesn’t slow down because a module is missing, it slows because something smaller is missing:

- Racking clamps

- Cable management

- Connectors

- Wiring kits

We stock and coordinate the entire system modules, inverters, BOS, racking from trusted commercial-grade brands.

What this means for developers and EPCs:

- One partner accountable for the full bill of materials

- One delivery schedule

- Zero surprises from multi-vendor mismatches

A partial shipment is a full delay. We eliminate that risk.

3. Guaranteed Pricing That Protects Margins

Wood Mackenzie identifies mid-project price volatility as a top-three threat to EPC profitability in 2025-2026[2].

ESAS mitigates that through pre-negotiated vendor partnerships, allowing us to secure stable, predictable pricing for the duration of your project cycle.

This protects:

- IRR projections

- Budget accuracy

- Profit margins

- Investor confidence

Your pricing stays stable so your financial model stays intact.

The ESAS Difference: Customer Intimacy & 3-I Quality Assurance

Our logistics framework is built on the philosophy that we don’t just ship materials,we protect your project schedule.

Every shipment goes through the ESAS 3-I Quality Process:

Inspection → Inspection → Inspection

because one damaged pallet or wrong SKU can delay an entire job site.

This is why developers choose ESAS not just as a distributor, but as a project reliability partner.

The Industry Is Entering a New Era and Logistics Will Decide Who Wins

C&I solar is becoming a race not just to design better systems, but to deliver them on time.

The next generation of leading EPCs and developers will be the ones who remove uncertainty from their supply chain.

If logistics is the new battleground, then ESAS is both your shield and your speed advantage.

Ready to turn your project pipeline into predictable, on-schedule commissioning?

Let’s build with certainty.

Stay Connected with ESAS

Energy Solutions and Supplies LLC

33 West Broadway Road, Mesa, AZ, Chandler, AZ, United States, 85210

Phone: +1 480-478-1616

Email: marketing@site_e004437c-3a10-4965-98d4-bf1bded3bef9

Website: www.site_e004437c-3a10-4965-98d4-bf1bded3bef9

Latest Events and Updates:

Our Events | Trade Events

Stay connected with us on

LinkedIn, Facebook, Instagram, and YouTube for the latest updates.

References

NREL – National Renewable Energy Laboratory. Benchmarking U.S. Solar Soft Costs 2023. https://www.nrel.gov/solar/

SEIA & Wood Mackenzie. U.S. Solar Market Insight Report 2024–2025. Solar Energy Industries Association. https://www.seia.org/us-solar-market-insight

Wood Mackenzie Power & Renewables. Commercial Solar Trends & Procurement Challenges 2024–2025. https://www.woodmac.com

U.S. Department of Energy (DOE), Solar Energy Technologies Office. Grid Hardware & Equipment Lead Time Updates 2024–2025. https://www.energy.gov/solar